Description

| Topics Covered in the Class 12th Accounts Course – | |

| Units | Details |

| Accounting for Partnership Firms | Fundamentals of Partnership: Features of Partnership, Partnership Deed, Provisions of the Indian Partnership Act 1932 in the absence of Partnership Deed, Preparation of Fixed & Fluctuating Capital Accounts, Preparation of Profit and Loss Appropriation Account (for division of profits), Guarantee of Profits, Past Adjustments (relating to interest on capital, interest on drawing, salary and profit sharing ratio) Goodwill Valuation: Goodwill − Nature, Factors affecting Goodwill and Methods of Valuation – Average Profit, Super Profit and Capitalisation Change in the Profit Sharing Ratio among the Existing Partners: Calculation of Sacrificing ratio, Gaining ratio, Accounting for Goodwill and Accumulated Profits, Preparation of Revaluation Account and Balance Sheet Admission of a Partner: Calculation of New Ratio and effect of Admission of a Partner on change in the profit sharing ratio, Treatment of Goodwill (as per AS 26), Treatment of Reserves and Accumulated Profits, Treatment for Revaluation of Assets and Reassessment of Liabilities, Adjustment of Capital Accounts and Preparation of Balance Sheet Retirement / Death of a Partner: Calculation of New Ratio and effect of Retirement / Death of a Partner on change in profit sharing ratio, Treatment of Goodwill (as per AS 26), Treatment of Reserves and Accumulated Profits, Treatment for Revaluation of Assets and Reassessment of Liabilities, Adjustment of Capital Accounts and Preparation of Balance Sheet, Preparation of Loan Account of the Retiring Partner, Calculation of Deceased Partner’s share of Profit till the date of death, Preparation of Deceased Partner’s Capital Account and Executor’s Account Dissolution of Partnership Firms: Settlement of accounts – Preparation of Realisation Account, Capital Accounts of Partners and Cash/Bank Account |

| Accounting for Companies | Accounting for Share Capital: Share and Share Capital – Nature, Types; Accounting for Share Capital − Issue and Allotment of Equity Shares, Public Subscription of Shares – Over Subscription and Under Subscription of Shares, Issue at Par and at Premium, Calls in Advance and Arrears, Issue of Shares for Consideration other than Cash, Accounting Treatment of Forfeiture and Re-issue of Shares, Disclosure of Share Capital in Company’s Balance Sheet Accounting for Debentures: Debentures − Issue of debentures (at par, at a premium and at a discount), Issue of debentures for Consideration other than Cash, Issue of Debentures with Terms of Redemption, Debentures as Collateral Security, Interest on Debentures, Treatment of Discount or Loss on Issue of Debentures Redemption of Debentures: Lump Sum Method, Draw of Lots and Purchase in the Open Market, Creation of Debenture Redemption Reserve |

| Accounting for Not–for-Profit Organisations | Concept of Not-for-Profit Organizations, Receipts and Payments Account: Features and Preparation, Income and Expenditure Account: Features and Preparation, Preparation of Balance Sheet from Receipts and Payments Account with additional information, Treatment of Funds, Treatment of Consumables |

| Preparation of Financial Statements of Companies | Financial Statements of a Company: Statement of Profit and Loss and Balance Sheet in the prescribed form with major headings and sub headings (as per Schedule III to the Companies Act, 2013) Financial Statement Analysis: Objectives, Importance, Limitations, Tools for Financial Statement Analysis – Comparative Statements, Common Size Statements |

| Ratio Analysis | Liquidity Ratios − Current Ratio, Quick Ratio; Solvency Ratios − Debt to Equity Ratio, Total Asset to Debt Ratio, Proprietary Ratio, Interest Coverage Ratio; Activity Ratios − Inventory Turnover Ratio, Trade Receivables Turnover Ratio, Trade Payables Turnover Ratio and Working Capital Turnover Ratio; Profitability Ratios − Gross Profit Ratio, Operating Ratio, Operating Profit Ratio, Net Profit Ratio and Return on Investment |

| Cash Flow Statement | Meaning, Objectives and Preparation of Cash Flow Statement (as per AS 3 by Indirect Method) |

| ‘Things to Know’ before placing a Purchase Order:- | |

| Package Contents | Pen Drive 64GB (for Lectures) + 2 Printed Books Note : – The fees paid for the Course is Non-Refundable and Non-Transferable. – Course once subscribed cannot be cancelled. |

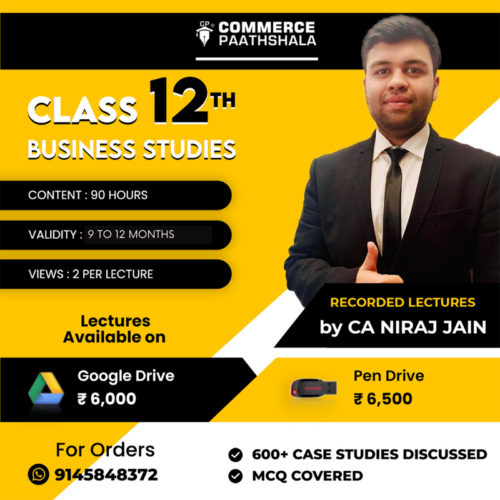

| Total Lecture Duration | 180 Hours (for full course coverage) Note : Each Lecture will roughly have a duration of 75 Minutes |

| Validity Period | 9 to 12 Months (depending upon the package purchased) Note : Extension of the Validity – can be done for 3 months by paying extra charges ₹ 1500. |

| Total Viewable Time | 2 Full Views per Lecture (Pause, Forward and Rewind features are available) Note : Students will be given ‘Double Time’ for each lecture. No limit of views for any lecture (subject to availability of time). For Example – A lecture of 1 Hour can be viewed any number of times till the expiry of total limit of 2 Hours i.e. Double Time |

| Lectures will Play On | – Windows Desktop, Windows Laptop, Android Phone Note: Software for Playing Lectures can be activated on Any One Device of your Choice. (Apple Devices are not Supported) Desktop, Projector, TV or any External Display or Mirroring or Screen Cast is Not Allowed Maximum allowed Screen Size of the Monitor is 24 inches. Device Change Request will be charged at ₹ 500 Extra– Software will be provided FREE of Cost to Play the Lectures Note : Students ID Proof i.e., Aadhar card or Passport or Latest School ID Card will be required for Course Activation on Software. First Time Activation will be FREE. Software ‘ID Re-Activation’ Request will be charged at ₹ 500 Extra |

| Tech Requirements | (For PC or Laptop) Processor – Core 2 Duo (2 GHz) Processor or Above RAM – 2GB or Above Operating System – Windows 7 (Ultimate, Home Premium, Professional, and Enterprise), 8, 8.1 and 10 (Not Supported Versions : Windows XP, Windows Vista, Windows 7 Starter, Windows 7 Home Basic, Windows 7 N Edition, Windows 7 KN Edition, Apple IOS) (For Phone) Only Android Version 9 or Above with atleast 2 GB RAM. Note : – Internet Connection will be required for ‘Installing and Updating the Software’ provided to play the Lectures. – Please be informed that, you shall not update the Laptop/PC/Mobile OS Version after installing the Software as this will make the Software and Lectures Unplayable. Software ‘ID Re-Activation’ Request will be charged at ₹ 500 Extra |

| Video Language | Hinglish |

| Book Language | English |

| Dispatch Time | Within 72 Hours of Placing the Order |

| Delivery Time | 5-7 Working Days from date of Placing the Order (Package will be delivered through SPEED POST or DELHIVERY as per availability at the given PIN CODE) |

| Extra Classes | Extra Classes will be shared on YouTube if any changes are made in the syllabus in between the Session |

| Doubts Solution | “CA Niraj Jain” Sir’s WhatsApp Number will be given to the Student for only Subject related Doubts Solution. Note : Doubts Solution over Voice or Video Call will be at the discretion of CA Niraj Jain Sir only. |

| Software Problem or Problem in Playing Classes | A dedicated Tech-Support Team’s Contact Number will be given to the Student which will be functional from Monday to Saturday (11 AM to 5 PM) except on Public Holidays or Festivals. |